I hope that you and your family are safe during these challenging times.

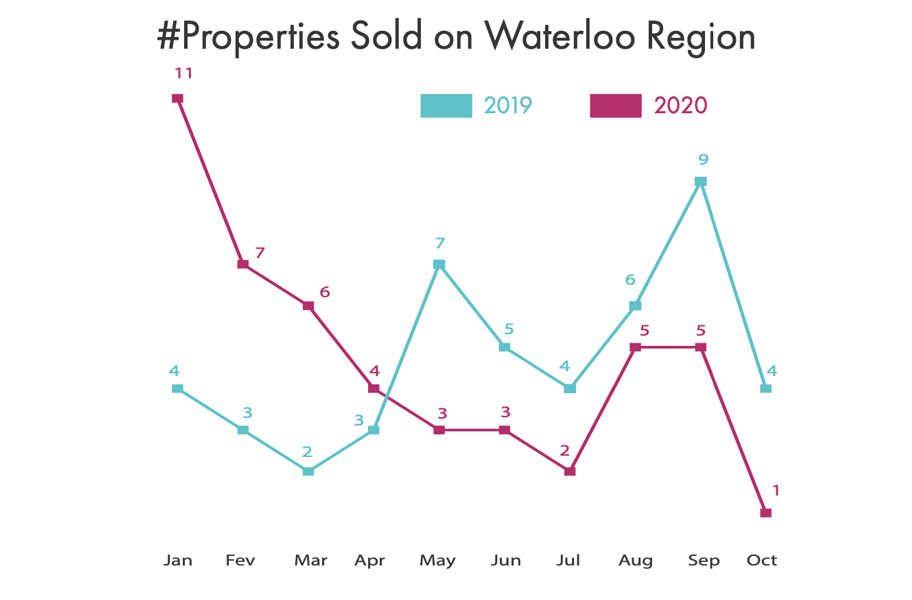

Without question the biggest driver in the multi family market right now on the demand side is interest rates. As rates have dropped, due to the pandemic, capitalization rates have followed suit to all time record lows. Owners of apartment buildings have also seen their property values rise significantly, and they are now taking advantage of record low refinancing opportunities through CMHC. The pandemic has also proven the resiliency and strength of the multi family sector. As stock market and real estate investors from other sectors look for safe havens during unpredictable times – we have seen new buyers enter the market adding even more demand for the asset class.

On the supply side – Owners are taking note of the significant jump in property values. While these prices may be tempting for some, many struggle with concern over significant capital gains tax that will be incurred and limited investment alternatives from the proceeds of the sale.

The market has changed dramatically in the last two years. Rents have jumped significantly, while cap rates and inter- est rates are at historical lows. I hope that you find the information in this edition of the Landlord Report to be helpful, and as always, feel free to give me a call, text or email if you would like to chat sometime about the value of your apartment building.