Written by Kyle Church, Multi family Broker – December 2021

Across the country, the residential housing market (both single and multi family) have seen substantial gains throughout the pandemic and has put pressure on housing affordability in all major and mid market cities. While governments at all levels struggle with providing solutions to solve the housing shortage, rents and house prices continue to climb as supply simply cannot keep up with demand. Housing affordability is not an issue that will be solved in a short period of time, which has led to increased investment in the multi family asset class.

While owners have been satisfied with the increased values they have seen throughout 2021, investors on the sidelines holding cash are kept up at night by the fear of inflation. The Consumer Price Index increased to 4.4% in September, further proving that inflation is here with no sign of this concern disappearing soon. While the cost of borrowing still remains low, Buyers are even further motivated to find an asset to get their cash invested before inflation devalues their capital and interest rates rise to combat inflation.

It is fair to say that 2021 has also been a great year for institutional landlords who have been able to expand their portfolio across the country. REITs have grown their portfolios significantly by buying smaller portfolios held by smaller groups and families that have decided to exit the market.

“Buyers are even further motivated to find an asset to get their cash invested before inflation devalues their capital and interest rates rise to combat inflation.”

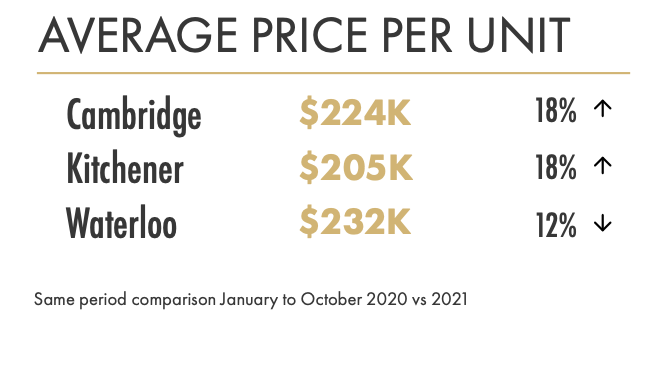

Canada’s major markets of Toronto, Vancouver and Montreal are seeing exceptional competition for Class A assets which has led to many private funds adjusting their acquisition targets onto smaller mid market buildings in hopes of finding better opportunities. This has led to the smaller regional markets outside of the major cities seeing significant gains and competitive bids.

Looking forward to 2022, it is anticipated that the market will remain imbalanced between supply and demand for multi family opportunities. If inflation continues to rise, this could limit the number of Sellers divesting of their properties unless they have plans to reinvest their proceeds from a sale. The past year has also seen a lot of new rental construction projects started, which will completed in the year ahead. While we know the demand is there for these new rental units, it will be interesting to see if this creates some mobility in the market of longer term tenants in older apartment buildings.

Kyle Church is a Multi family realtor with Royal LePage Commercial focused on selling apartment buildings in Southwestern Ontario.