Greetings Landlords,

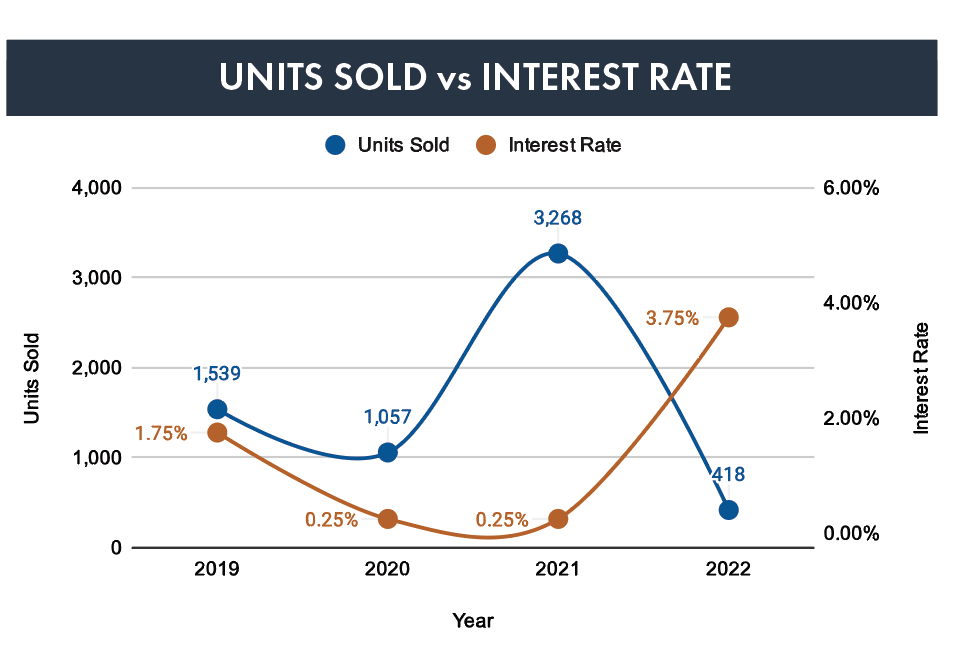

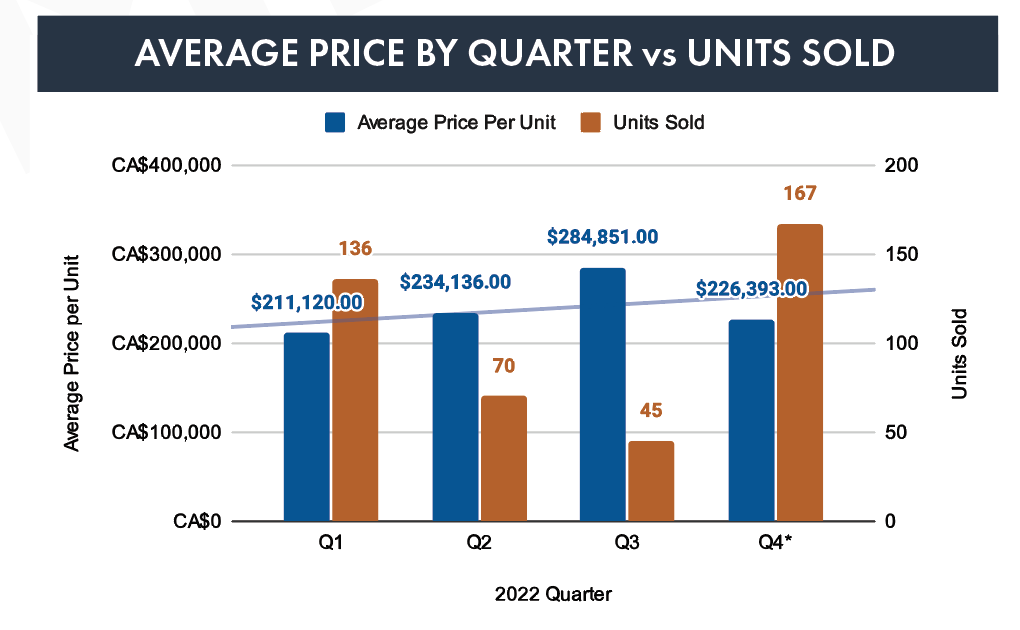

As you can imagine – we have experienced a significant decline in transaction volume in the third quarter of 2022 – a direct result of the rising cost of interest rates in an effort to combat inflation. While we hear in the news about single family housing dropping in value in recent months, the multi family market remains in an exploratory phase, as Buyers and Sellers sort out current pricing in this higher interest rate environment.

It is fair to say that we have not observed a significant decrease in apartment values. I believe this is the result of owners of apartment buildings being less motivated to sell in the current market, and their unwillingness to sell at a price lower than would have been possible several months prior.

The buyer pool has reduced significantly, as many investors have their “pens down” while they wait to see the impact of higher interest rates. Some buyers feel there may be better opportunities on the horizon in the coming months, while others view now as a good time to buy with less competition for properties that would have previously attracted a lot of interest.

At Principal Interest, we continue to sell apartment buildings as we have identified which buyers are still actively buying and matching them with opportunities that fit their criteria. For the most part, Buyers are looking for value-add opportunities where they will be able to significantly improve their return by renovating and increasing rents.

Personally, I hold an optimistic view that interest rates will stabilize in early 2023, and as inflation falls back into line and rates slowly decline, buyers will return in full force as the fundamentals of multi family investing remain extremely strong from a long term perspective.

As always, feel free to reach out if you wish to discuss anytime.

Kyle