Resilient Multi Family Market Holds “Strong-ish” Despite Increased Borrowing Costs – By Kyle Church, Broker

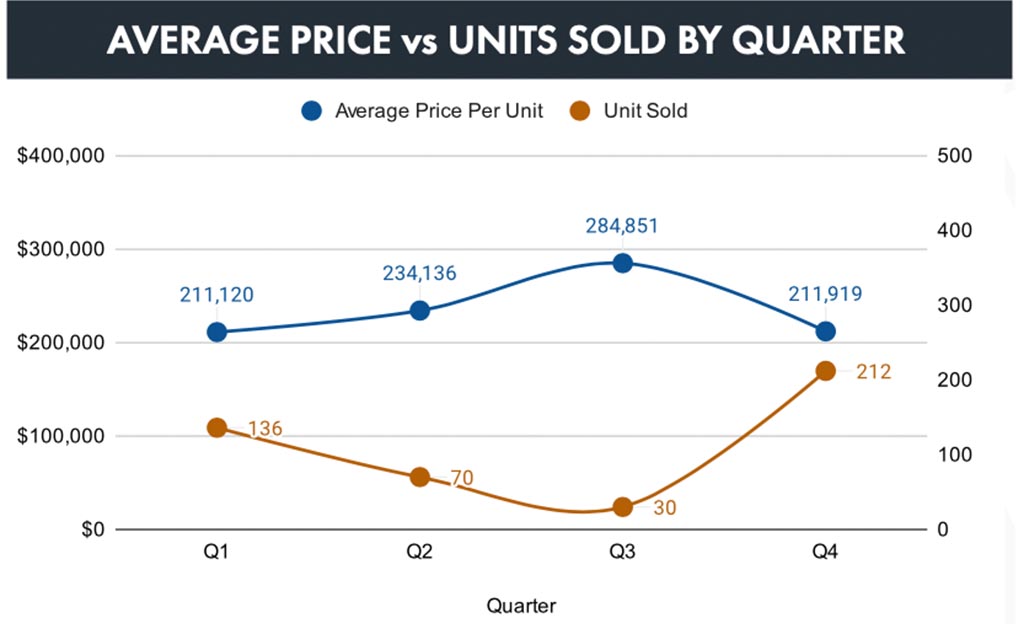

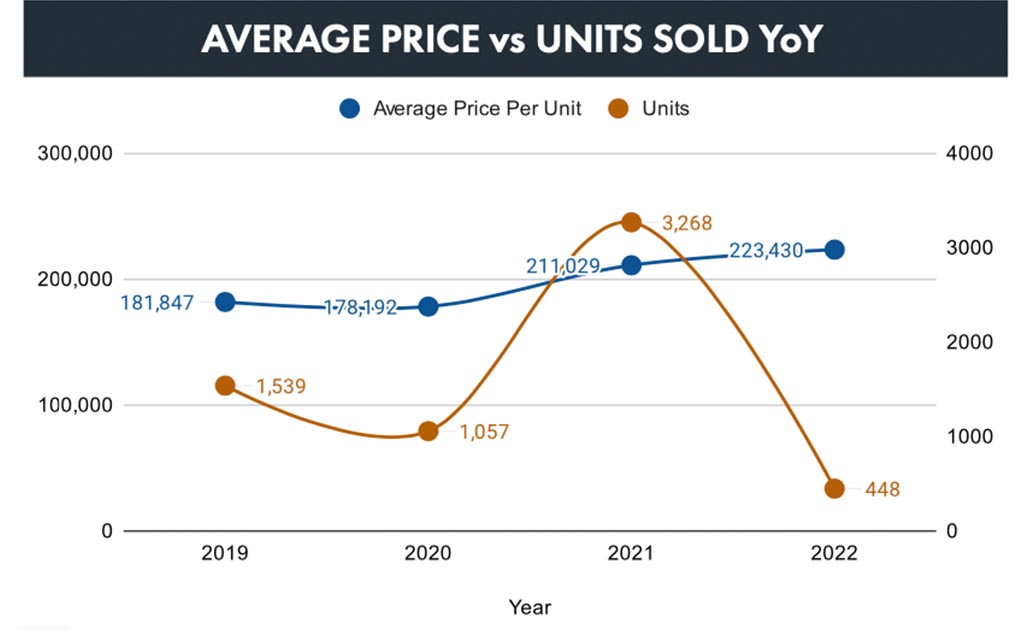

The past twelve months have been a slower yet interesting time for the real estate market. From a single family housing perspective, we have seen home prices decline by 20% or so, depending on the local market. Apartments, however, have held their value for the most part, while deal volume has dropped off considerably.

The markets of 2021 and 2022 could not have been any more different, yet despite this reality, owner/sellers generally have their expectations set to the incredible valuations we saw in 2021. Listings that in the past would have had multiple offers, now sit on the market for 30 or 60 days, and in some instances, do not sell. Properties must be considered on a case by case basis for the opportunity that they present and the type of buyers they will attract. Many buyers who were previously active in 2021 remain on the sidelines – some hopeful there will be better buying opportunities in the months ahead. Listings that would previously sell with firm unconditional offers are now accepting offers with 30 to 60 day long conditional periods.

This was the story of 2022 and the beginning of 2023. Throughout this time, the Bank of Canada was aggressively increasing rates and have now signaled that we could be at the end of this tightening cycle. Will Buyers come back to the table and will they be able to digest still significantly higher interest rates from the incredible low of 2021? Time will tell but I feel that if interest rates start to come down at the end of 2023, even just a little bit – we will see deal volume increase again. Some sellers are holding off right now and will eventually need to sell. Investors sitting on cash and waiting for the market to drop may reenter the market and put more cash down if it appears we are going to have a “soft” landing.

In my opinion, it is unlikely that we will see a decrease in average per unit sale prices. It is more likely that we will see a gradual increase over time with capitalization rates climbing from the 3% range up towards the lower range of 4%. Keep in mind that owners can still force appreciation on their properties with increased rental revenue and finding operating efficiencies.

One thing is for sure – the market is evolving and adapting to the impacts of higher interest rates. It is more important now than ever to work with an experienced and connected real estate broker if you are considering transacting in this market. If you plan to buy or sell in the year ahead – I hope we can chat in the coming weeks and months about your plans and if we may be able to help you achieve your goals.

Feel free to call, email or text message if you have any questions or would like to discuss further.

Kyle