Written by Kyle Church, Multi family Broker – May 2022

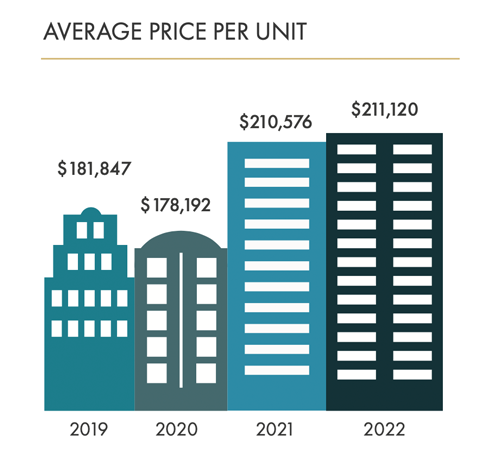

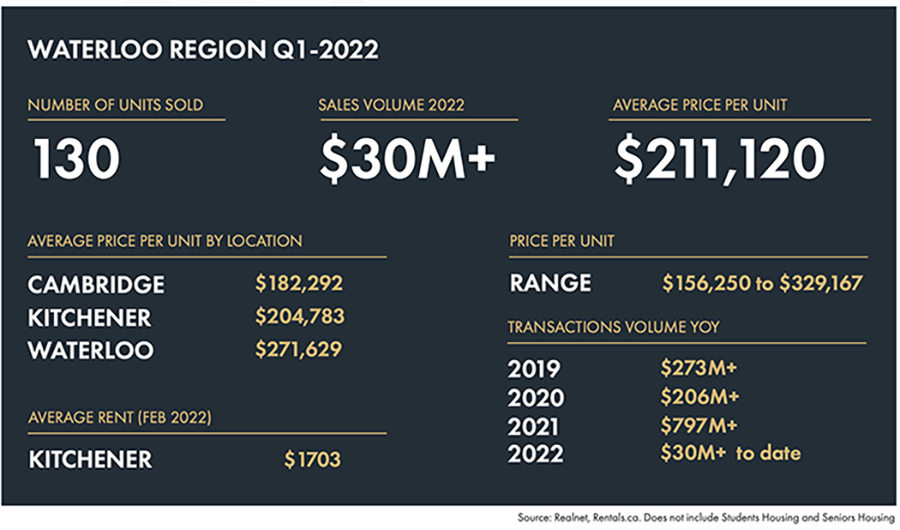

As we all know, the pandemic brought with it incredibly low interest rates. This low cost of borrowing was the fuel behind the multi family market being on fire for the past two years. With the Bank of Canada announcing an interest rate of 0.5% this past week – the fuel is being turned down and both Buyers and Sellers of apartment buildings are taking note and curious to see what happens next.

It’s been an interesting couple weeks as a broker of multi family buildings. Deals under contract continue to proceed as planned and Buyers seem to have priced in the cost of funds into their decision making on current deals. With that being said, I have noticed an increase in the number of owners reaching out to me in recent weeks – asking me to provide them with an opinion of value on their property.

“I believe without a doubt we will see an increased supply of opportunities in the months ahead.”

Source: Realnet and personal database, does not include Students Housing and Seniors Housing

Fundamentally, our market is a function of supply and demand. I believe without a doubt we will see an increased supply of opportunities in the months ahead. With the increasing supply of apartment buildings – it will be interesting to see if Buyers are willing to pay Q1 prices, given they are having to borrow funds at significantly higher rates.

Are you considering buying or selling in this current market? Please reach out as we would be happy to discuss the current market conditions, the value of your apartment building, or share some off market opportunities that may be a great fit to your portfolio. We are happy to share with you up to date market data and recent transactions to help you make the best decisions.

Kyle Church is a Multi family realtor with Royal LePage Commercial focused on selling apartment buildings in Southwestern Ontario.